HOW IT WORKS

1. Determine the amount you are able to donate.

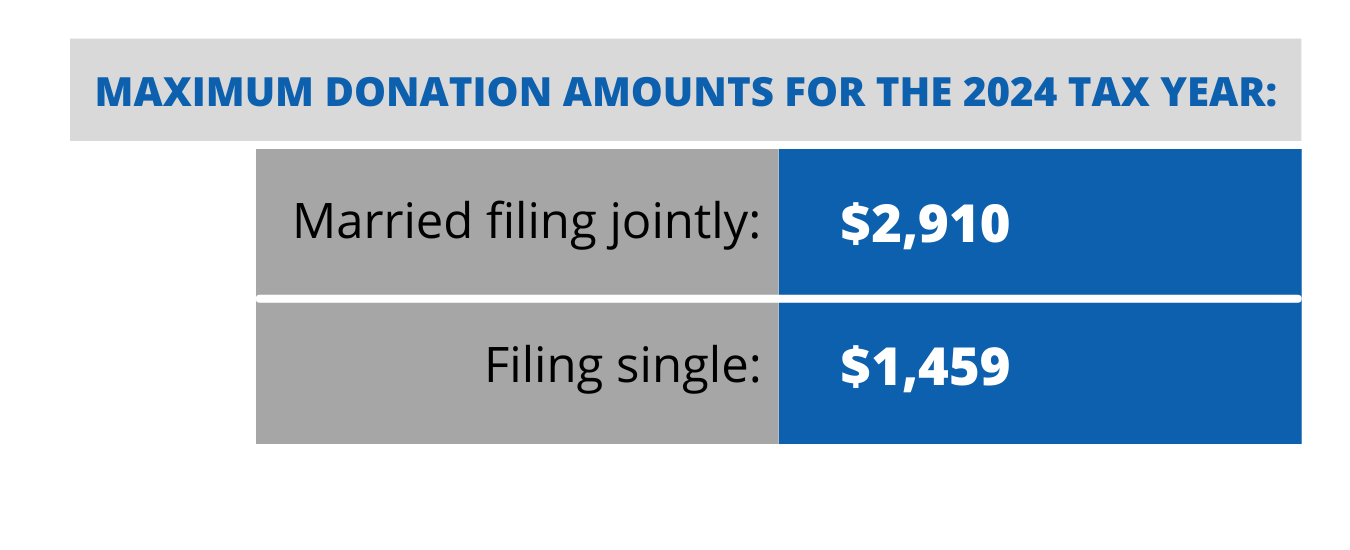

You can donate up to the maximum amounts set by the state as shown below, or your tax liability. If you are unsure how much you can donate, we recommend speaking with a tax professional to determine your liability.

2. Determine if you would like to recommend a school or a student for your donation.

Recommending a student is optional. If recommending a student, you will need to know the student’s name and the school they attend. Arizona Tuition Connection will follow the intent of your recommendation to the extent the law will allow. It is important to realize that not every student is eligible to receive every type of scholarship award. Donations received without a student recommendation, or donations received in which the recommended student is not eligible, will be pooled and awarded to low-income families.

3. Make your donation.

You can donate three ways: on our secured website, by check, or by phone. A receipt will be sent to you after you complete your donation. Ready to donate now? Click here.

4. Do you have additional tax liability you would like to donate?

Arizona has 5 major tax credits for individuals. Arizona Tuition Connection participates in the private school tax credit. If you have additional tax liability you would like to donate or if you would like to learn more about the other tax credits, please go to AZTAXCREDITFUNDS.COM.

5. Take the credit.

Take your donation as a credit when you file your Arizona State Taxes by giving your receipt to your tax preparer. If you need a copy of your receipt, you can request one here:

Or, if you file your own taxes, you can download our TurboTax Guide:

There are some rules you need to be aware of:

It is against the law to donate to kids within your own household.

It is against the law to swap donations with another family.