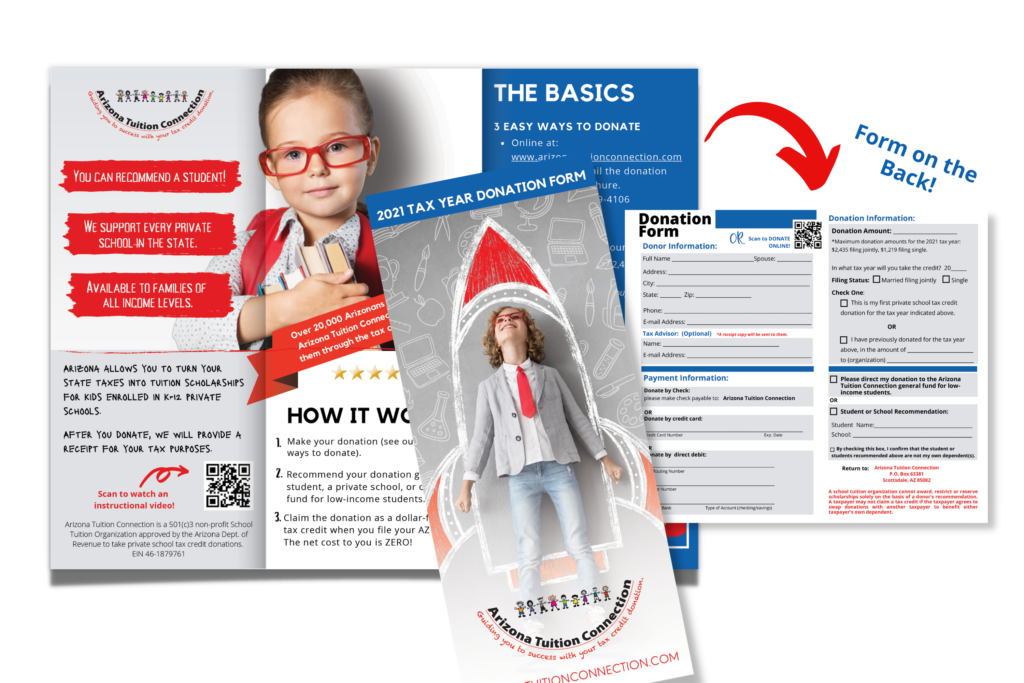

Brochures

You can contact us for professionally printed brochures or download and print them yourself. Remember to pre-fill them with your child’s name and school to assure the donations get credited to your family!

If you would like us to mail you any of these resources, please fill out the form below.

Thank You Notes

We know you want to say “Thank you!

We’re excited to offer a new thank you note program! Send us completed thank you notes without mailing addresses, and we’ll print your donor’s address and mail them for you.

Here is how to get started!

Step 1: Prepare your cards (Please initially send 10 cards, we will request more when we need them.)

- Purchase cards and write a thank you message for the donor inside the card.

- Seal the card in an envelope

- Write your return address on the outside of the envelope. Place a postage stamp on the envelope.

- Leave the rest of the front of the envelope BLANK. WE will address it to the donor.

Step 2: Mail them to us.

- Place all of your sealed/stamped cards into a large envelope and mail it to:

Arizona Tuition Connection

11445 E. Via Linda, Ste. 2-145

Scottsdale, AZ 85259

We will address and send them to your donors for you.

Applicant Forms

Prior School Verification Form

This form is required by all students transferring from a public or charter school and must be completed by an official at the school they are transferring from.

Previous Scholarship Award Verification Form

This form is required for students that are new to working with Arizona Tuition Connection and received a scholarship in a previous school year from a different School Tuition Organization. It must be completed by the School Tuition Organization that issued the award or by the private school that received the scholarship on your child’s behalf.

Request a Summary of Recent Donations.

Social Media Shareables

Click and download any of the graphics below, share across your social media accounts!

Click to follow us on Facebook!

Click to follow us on Facebook!

Matching Gifts

Many employers sponsor matching gift programs for charitable contributions made by their employees. Click below to see if your employer, or your donors’ employers, offer matching gifts.

Click here to check employer matching

YES! Those matching funds can go to your child!

Matching Gift data provided exclusively under these Terms of Use by HEP Development Services