If you have chosen to use ESA for your child this school year, we encourage you to still get tax credit donations where your child is recommended to receive those funds.

In order for us to allocate and hold funds for your child, you have to do two things:

First, your child has to remain in private school. If you move them to a public, charter or home school, even for a day, we can’t allocate the funds to your family.

Next, you have to keep a current application with Arizona Tuition Connection. You can go complete your application on our website or by calling us at 480-409-4106.

If you do these two things we can allocate funds for your child through 12th grade.

To view video in Spanish, click here.

Although the law allows a student to start the school year on ESA, and then move to tax credit scholarships at the end of any quarter, most schools will not allow it. So, if you are thinking of making this change please discuss it with your school first.

Like most schools, we encourage parents to pick either ESA or tax credits scholarships for an entire school year. Each summer you can evaluate what is best for your family for the upcoming year.

As a reminder, we strongly encourage all parents to continue to get tax credit donations, no matter if their family is on ESA or tax credits.

To view the video in Spanish, click here.

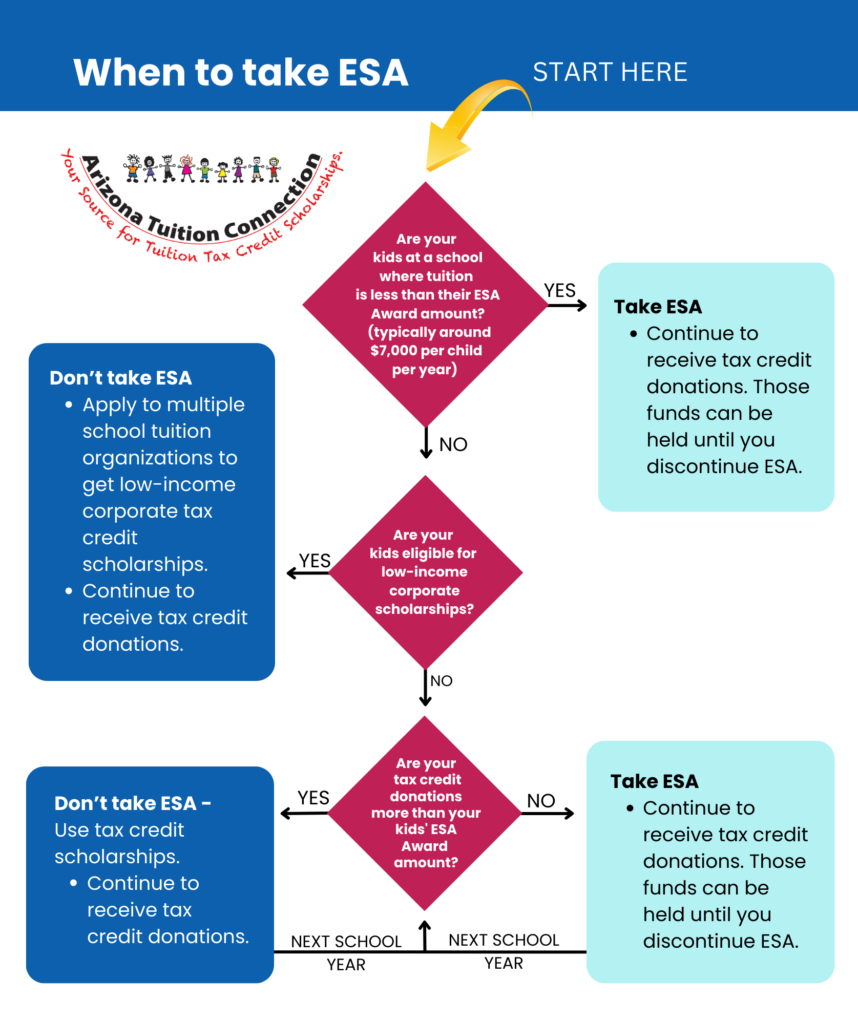

Your strategy for maximizing your child’s scholarship funds will vary depending on the income of your family.

If your family is blessed with a higher income, the best strategy is to utilize the guaranteed ESA funding until your tax credit donations exceed your ESA amount. In the year we are holding more in tax credit donations than your ESA amount, switch from ESA to using your allocated tax credit funds. For example, if the ESA amount is $7,000, continue using ESA until you accumulate more than $7,000 in tax credit donations for your child.

Also, for higher-income families, we recommend picking just one School Tuition Organization to work with, you will find it is much simpler.

If your family is low to middle-income, they may be eligible for low-income corporate scholarships. The best strategy for your family is to apply to multiple School Tuition Organizations receiving low-income corporate scholarships from each.

Additionally, it is important to continue to solicit tax donations where your child is recommended to receive those funds. The combination of corporate low-income scholarships combined with donated funds typically provides more funding than using ESA.

If you have questions on a strategy for your family, please reach out to Arizona Tuition Connection, we are here to help.

To view video in Spanish, click here.

We currently offer 3 convenient ways to apply for scholarships.

- Online. You will start by creating an online profile so that you can save progress and revisit your applications. Apply online here.

- Apply-by-Phone. If you would prefer to have one of our team members assist you this process, you can call us at: (480) 409-4106, or make an appointment by clicking here. Please be prepared to provide the gross income for each member of your household matching the previous year’s tax filing.

- Download a paper application. Once completed, you can mail to:

11445 E Via Linda #2-145

Scottsdale AZ, 85259

Or scan and email to: applications@arizonatuitionconnection.com

To view video in Spanish, click here.

The year before your child enters private school is the ideal time to begin securing tax credit donations. For many families, this means when your child is 4 years old or in 8th grade. If we receive tax credit donations recommending your child as a beneficiary during that year, we can hold the funds and allocate them in future years.

If you missed the opportunity to start early, the next best time is now. So Apply – Educate Yourself – Get your tools ready and start a conversation with your social network about redirecting their taxes to your family’s tuition.

To view video in Spanish, click here.

We can award tax credit scholarships to students attending any private school in Arizona. Please note that these funds are primarily intended for students in Kindergarten through 12th grade.

To view video in Spanish, click here.

There are four scholarships available through this tax credit program. Most students enrolled in private schools in Arizona can qualify for at least two of them, and depending on your family’s circumstances, you may be eligible for more.

However, if your child is receiving ESA funds, they cannot, by law, receive tax credit scholarships at the same time.

Once you complete your application with Arizona Tuition Connection, our team will email you with details on which scholarships your child is eligible to receive.

To view video in Spanish, click here.

Arizona Tuition Connection has no application deadlines, so it’s never too late to apply. However, the sooner you submit your application, the better, as we cannot award scholarships without a completed application.

We typically start taking applications for the upcoming school year after May 15th.

To view the video in Spanish, click here.

There are currently four types of scholarships that Arizona Tuition Connection provides. (At this time we do not have the 4th scholarship, called disabled / displace, available)

1) The Original tax credit Scholarship. – There are some general guidelines by the state for these scholarships, but essentially all K-12 children attending a qualified private school can receive Original Scholarships.

2) The Switcher (Overflow/PLUS) tax credit scholarship. – The state has set some very specific award guidelines to receive this type of scholarship.

– Enrolling in or currently enrolled in a private school kindergarten, OR

– Attended an Arizona public school, full time, for at least 90 days of the prior fiscal year and then transferred to a private school, OR

– Are transferring from an out-of-state school, OR

– Attended a homeschool program in the previous year, OR

– Were previously receiving ESA funds, and have discontinued the ESA program, OR

– Received a switcher scholarship in a prior school year and remained in private school in subsequent years, OR

– Received a low-income corporate scholarship or disabled/displaced scholarship in a prior year and continued to attend private school in subsequent years, OR

– Moved to Arizona from out of state before enrolling in a private school.

3) The Corporate Low-Income tax credit scholarship. – There is an income cap, plus other requirements to receive low-income corporate scholarships.

– Family income must be below the numbers indicated in the chart below AND meet one of the following:

– Enrolling in or currently enrolled in a private school kindergarten, OR

– Attended a Arizona public school, full time, for at least 90 days of the prior fiscal year and then transferred to a private school, OR

– Received a switcher scholarship in a prior school year and remained in private school in subsequent years, OR

– Received a low-income corporate, switcher or original scholarship in a prior year and continued to attend private school in subsequent years, OR

– Were previously receiving ESA funds, and have discontinued the ESA program,

Academic Year 2024/25

| Household Size | 342.25% of poverty level (185% of poverty level) |

| 1 | $51,543 |

| 2 | $69,956 |

| 3 | $88,369 |

| 4 | $106,782 |

| 5 | $125,195 |

| 6 | $143,608 |

| 7 | $162,021 |

| 8 | $180,434 |

| Each additional member | $18,413 |

Once you apply you will receive an email confirmation of which type of scholarships your child is eligible to receive. It is important for you to understand what type of scholarships your child is eligible for, to make certain you receive all possible awards.

There is only one application. Simply complete that application and our team will determine which scholarships your child is eligible to receive.

Our goal is to award scholarships out monthly.

About a week after we award scholarships to the school, we send the parents an email with the details of the scholarship award.

We encourage all families to educate themselves, use the tools we offer, and ask their social contacts to donate and recommend those funds to their family. It is not a good strategy for parents to expect scholarships other than from those that have been recommended to their family.

Arizona Tuition Connection uses the recommendation of the donor as the primary criteria for awarding scholarships. It is important for parents to understand not every child is eligible for every type of scholarship.

The first thing parents must understand is how donations are categorized.

When donations are received from individuals, Arizona Tuition Connection must categorize those donations as available to be used for two different types of scholarships. For donations coming in from married couples for the 2024 tax year, the first $1,459 of each donation must be used for Original Scholarship Awards. Any amount over $1,459 (up to an additional $1,451) must be used for Switcher Scholarships. For singles who donate, the first $731 must be used for Original Scholarship awards, with any amount over (up to an additional $728) going towards Switcher scholarships.

For example: If we receive a donation for $2,000 in the 2024 tax year from a married couple, $1,459 will be available for Original scholarships and $541 will be available for Switcher scholarships.

The next thing for parents to understand is what type of scholarship awards their child is eligible for – Original, or both Original and Switcher. This information is part of a previous FAQ question in this section.

If your child is not switcher eligible, we cannot award your child a switcher scholarship even if your child has been recommended to receive those funds. If your child is switcher eligible, then they would be eligible for scholarships from both original and switcher parts of the donation.

To view the video in Spanish, click here.

First, understand that scholarships come from donations. If there are no donations there are no scholarships. Therefore, the best way to maximize your scholarship awards is by increasing the donations where your family is recommended to receive those funds.

Over the years the maximum donation amounts have grown significantly. With these generous limits, it doesn’t take long to make a significant impact on your tuition expenses.

Additionally, many employers offer matching gift programs for donations made to non-profits. In most cases, we qualify for these matches. Encourage your donors to check with their employers to see if they offer such a program. For more details, visit the matching gifts section of our website.

Finally, be sure to take full advantage of the programs we offer:

Do you have brochures ready to hand out?

Is your donation page set up and shared on Facebook?

Are you participating in our thank-you note program?

By staying proactive and engaged, you can help maximize the financial support for your family’s tuition.

To view video in Spanish, click here.

State law does not allow us to share the names of any of the donors. We must abide by that law.

We are allowed to share the total dollars that have been donated and recommended to your family. The easiest way to do this is to send us an email at info@arizonatuitionconnection.com and ask us to provide you that information. Please be certain to provide us the name of your child in your email.

What are the most common questions I will be asked?

1. How much can an individual donate? For the tax year 2024, the maximum a married couple filing jointly can donate is $2,910, and $1,459 for a single person.

2. What are the donation deadlines? – Your donors have until April 15th, 2025 to donate and take it off 2024 taxes.

3. I don’t pay taxes, do I get a refund? – Participating in this program has nothing to do with if they are getting a refund or if they owe taxes when they file their return. It has to do with if they have a tax liability. Their tax liability is their total state tax bill for the year. This program lowers your tax liability.

4. Is this the same as the Public School Tax Credit of $400.00? No, they are totally separate programs. Actually, the state offers many different tax credits. Residents can participate in them all.

Don’t give up. You may have to ask 20 different people to donate, before one says yes. But it is worth it. Donors tend to donate to the same family every year. So each new donor added can mean multiple years of scholarship awards.

Here are some more things to consider:

1. Educate yourself and develop talking points you are comfortable with.

Attend one of our coaching sessions. A list of sessions can be found on the home page of our website. We can’t stress enough how important being educated on this program is.

Common talking points often center around:

It costs you nothing to donate because it is a tax credit donation.

You are going to be paying the money to someone, either the state of Arizona or our family – This helps our family.

2. Be intentional.

Make a list of people you know who are employed in Arizona, and establish a plan to contact them.

3. Use our free tools.

Create donation pages and personalized brochures to help get donations. These tools are an excellent way to start a conversation with potential donors. To get started send a picture of your child to marketing@arizonatuitionconnection.com. For more information, visit our personalized tools page.

4. Carry donation forms with you.

You never know when you will meet someone who can donate. Pre-fill them out as much as you can to make them easy for your donors.

5. Participate in the other programs we offer.

You will start to receive regular email communications of “tips and tricks” and programs that have been successful. The more you can participate in these programs, the more funds will be available for scholarships.

6. We are here to help.

Much of our staff are parents with kids in private schools who are now experiencing success in receiving donations. We have been in your shoes and we are here to help. Call us before you get frustrated, and let’s talk things through.